LARIMER COUNTY, Colo. — In just an instant, a lifetime of dreams was washed away Tuesday night for Clyde Romero Jr.

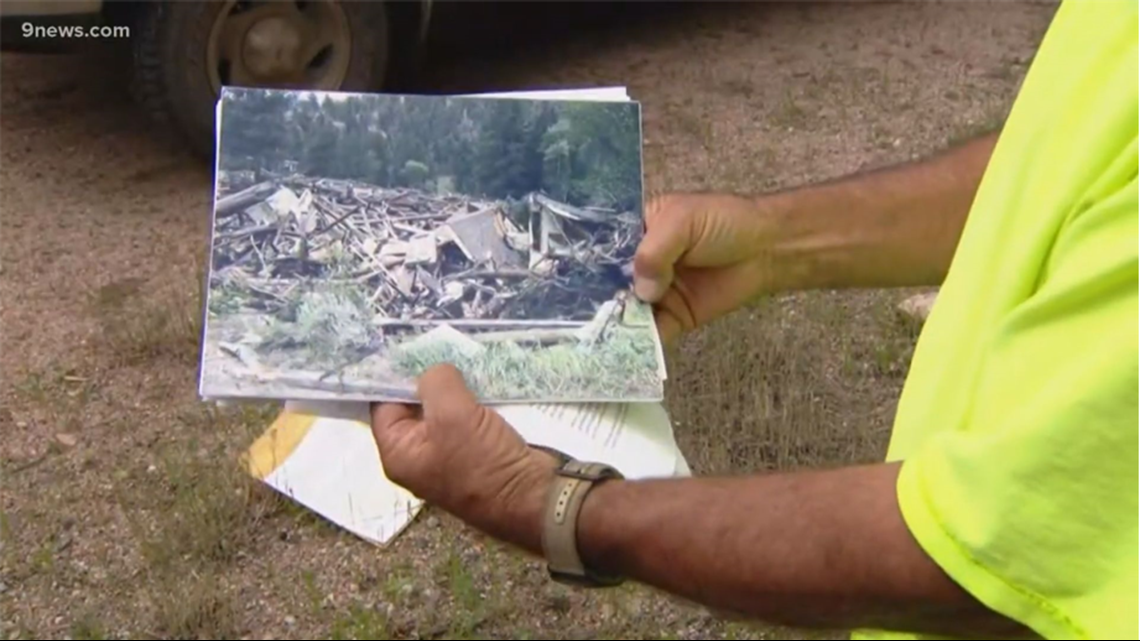

"I got a key to my house, but no house to go to," Romero said. "It's gone. It's obliterated."

Romero lives along the Poudre River on Black Hollow Road near the town of Rustic on Highway 14.

"This was my place. It was my dream home. I had it for three years," Romero said. "It was awesome. It was awesome."

On Tuesday night, Romero was away at his mother's house when heavy rains washed down the mountainside with a load of mud and debris. This is where the Cameron Peak fire burned last year and there is little undergrowth to slow down the rainfall.

Four people are feared dead with three still missing after their home was washed away, as well. Romero said he mourns for his friends and neighbors while he tries to figure out what he will do next.

"That's the roof of my house up against the bridge," Romero said. "I'm trying not to cry."

Though he lost everything, Romero said his insurance company called Auto-Owners determined he is not covered for mudslides or floods, meaning he will be out around $400,000.

"I was told that it's not affordable to have flood insurance, so I decided based on (Auto-Owner's) recommendation not to carry flood insurance," Romero said.

National Flood Insurance is available through FEMA and is designed to cover losses like Romero's. But, it does incur an additional cost on top of standard home insurance.

Romero wants Auto-Owners to reconsider his claim and help him out.

"I was willing to take the gamble, and you know, you put your best faith in the insurance company and hope they do the right thing," Romero said.

9NEWS reached out to Auto-Owners for comment but did not receive a response.

Despite his misfortune, Romero is thankful he wasn't home when it happened and promised to remain positive that God will provide.

"I'm gonna keep the faith and keep on plugging along," Romero said. "I may get more than what I had before."

Advice on flood insurance

Carole Walker, the Executive Director of the Rocky Mountain Insurance Information Association, explained that floods are not typically covered under standard homeowner's and renter's policies, so it requires purchasing separate flood insurance.

"...so you can purchase flood insurance either through the National Flood Insurance Program or in some cases through your insurance agent," she said, adding that mudslides could be covered under flood insurance.

The National Flood Insurance Program (NFIP), is operated by FEMA, and the insurance policy is made available to anyone in a municipality or county that participates in the program. Walker says much of the state is eligible.

As of March, just 20,000 policies under the NFIP were in Force.

However, Walker says flood insurance can prove to be expensive for those that live in flood-prone areas because the cost is based on the risk.

"People either think they're covered for it or we've had more awareness for the flooding we've had in Colorado as our most common natural disaster," she said. "They just choose not to purchase it because especially if you live in a high-risk flood area, flood insurance can be expensive and it is separate coverage. So people just take the chance, weigh the odds and choose not to buy it. And then some people just don't realize it's excluded from their homeowner's insurance."

Overall, she says it's important to get flood insurance in advance since it typically takes up to 30 days for flood insurance to go into effect.

"If you live in those areas where you had a major wildfire, that Cameron peak fire the East troublesome fire, you likely weren't at risk for flooding or high risk for flooding. Now you are," she said. "So you absolutely need to consider flood insurance. Unfortunately, it does take 30 days for flood insurance to go into effect before those rising floodwaters do happen."

Overall, she suggests customers in need of that type of insurance do a check-in with their insurance company.

"...know what you're covered for and what you're not covered for, what your deductibles are. We're in wildfire, flood and severe weather season. We haven't had that big hail storm yet," she said. "But make sure that you have the financial preparations in place to be able to really take care of any repairs, any losses, because believe me, when you do lose a home or you lose your personal belongings or even the roof is out because of a hail storm, insurance is the first thing you're going to be thinking about."

SUGGESTED VIDEOS: Storms and severe weather in Colorado