COLORADO, USA — Free school lunches are normally reserved for those most in need.

When public schools opened up for in-person learning after closing because of COVID-19, lunches were free for every student. The federal government suspended the income requirements for qualification.

That is no longer the case.

Free meals are, again, based on need.

But there is a question on the statewide ballot that brings back free meals for anyone regardless of need.

It would be paid for by taxpayers who earn the most.

A YES vote on Proposition FF means free school meals in public schools for everyone, paid for by increased taxes on those with $300,000 or more in federal adjusted gross income.

A NO vote means there is no new program, but students in need will still qualify. There would be no change to taxes for those making more than $300,000.

Currently, about 40% of K-12 students qualify for free meals based on the state's free and reduced-price school meal policy for the 2022-23 school year.

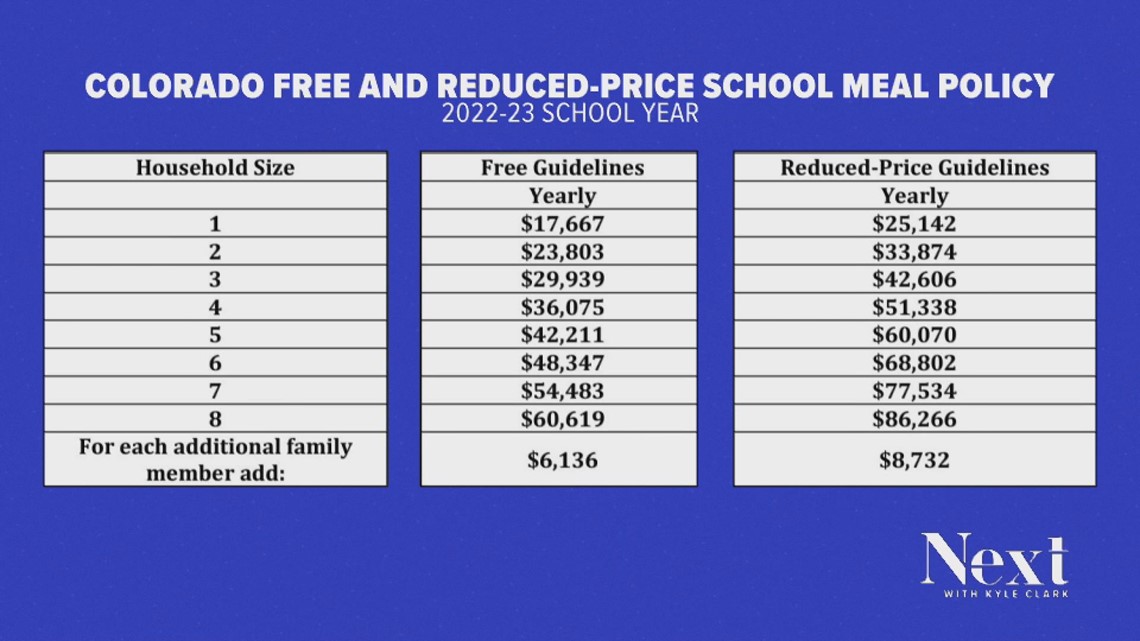

Public schools offer free and reduced-price lunches based on household size and family income.

For a family of four, the student qualifies for a free meal if the family income is less than $36,075. For a reduced-price meal, the family income needs to be less than $51,338.

The free and reduced-price school meal policy becomes obsolete if Proposition FF passes, because school meals would be free for anyone regardless of need.

Proposition FF requires school districts to maximize federal reimbursements by applying for certain federal grants.

Based on data from the Colorado Department of Education, schools in the state currently receive $415 million in federal grant money for school meals.

Under Proposition FF, whatever costs are not covered by federal funds would be covered by the state from increased taxes on those making more than $300,000.

Those taxpayers would be required to add back federal deductions when determining their state taxable income.

Single filers could only deduct up to $12,000.

Joint filers could only deduct up to $16,000.

Proposition FF would also provide school districts grant money to buy locally grown food, increase wages for cafeteria staff and grants to help train staff to prepare school meals with basic ingredients and minimal processed products.

This issue was put on the ballot by state lawmakers (double letter ballot issues indicate they were referred to votes by the legislature).

It passed the legislature with all Democrats voting in favor, along with five Republicans.

SUGGESTED VIDEOS: Elections 2022