DENVER — We received your questions about the early Taxpayer Bill of Rights (TABOR) refund coming from the state. Questions beyond, "Is this an election year stunt?"

Gov. Jared Polis announced that Colorado taxpayers will get a check in the mail later this year, ahead of the November election. As of June, payments are expected to be at least $750 for single filers and $1,500 for couples.

That money is part of next year's TABOR refund -- money the state has to return when it collects more than legally allowed.

The state will refund the money to people who file their tax returns by June 30 (the legislature updated this date; it was previously May 31).

We took your questions to Colorado Department of Revenue Executive Director Mark Ferrandino.

Q: How is the state getting the word out to make sure those residents get their refunds?

"One of the ways we get word out is by doing things like this. To do interviews to get it out to the press," said Ferrandino. "We are also making sure through, whether it's CPA, non-profits or others to remind people to file."

Even people with no income or low income can file a zero dollar tax return.

Those tax returns need to be filed by June 30 to be eligible for the check this year.

"If you have filed your taxes already or file by June 30, you will receive your check sometime between late August and September 15," said Ferrandino.

For tax filers who have an extension, they need to file by October 17, and Ferrandino said the TABOR refund checks would arrive in the beginning of 2023.

"It's important to remember this TABOR refund is for our fiscal year which ends on June 30 of this year, so once that is certified, you're owed this money."

Q: How are refunds issued?

TABOR refunds are not normally issued as a check in the mail to tax filers. Usually, the first chunk of money is as a senior and veteran property tax exemption. The next mechanism is a temporary reduction in the state income tax rate. The third way the money gets returned is through a sales tax refund.

The legislature is working on passing a bill to allow for these direct-to-taxpayer checks for some, not all, of the TABOR refund.

This change would increase the overall TABOR refund for people making $94,000 or less. For example, for single tax filers making between $47,001-$94,000 the increase in refund is $42. For joint filers in that income bracket, the increase is $84.

It would shrink the refund amount for people making more than $94,000. The more money you make, the greater the change in your refund. For example, a single tax filer who makes between $149,001-$207,000 would receive $89 fewer. People who make more than $263,001 would receive $447 fewer.

Q: Will the TABOR refunds, which are not normally checks directly in the mail, continue to be that and show up early every year?

"It is happening within the same fiscal year, we're just moving it up several -- six-to-nine months -- because, as Gov. Polis said, why are we holding onto money that is owed to you, let's get this back out to people," said Ferrandino. "Right now, the bill is one-time, but we're committed to having the conversation of, 'Does this make sense moving forward or are there other changes within the refund mechanism that would make sense?'"

Q: Why does it have to be a physical check instead of electronically delivered?

"We don't have people's bank account information for this. So, we need to send it out as checks. It was the best and easiest way for us to get this money out into your hands as quickly as possible," said Ferrandino. "One of the things and one of the importance around mailing checks, it's a tool to prevent fraud if people are able to put in fake bank accounts, and make sure that your check gets to you."

Q: What is the cost to send the checks to an estimated 3.1 million tax filers?

"To be able to send out the checks, it's roughly under .25%. It's roughly $3 million total to send out over $1.5 billion in checks (as of May) to the people of Colorado," said Ferrandino.

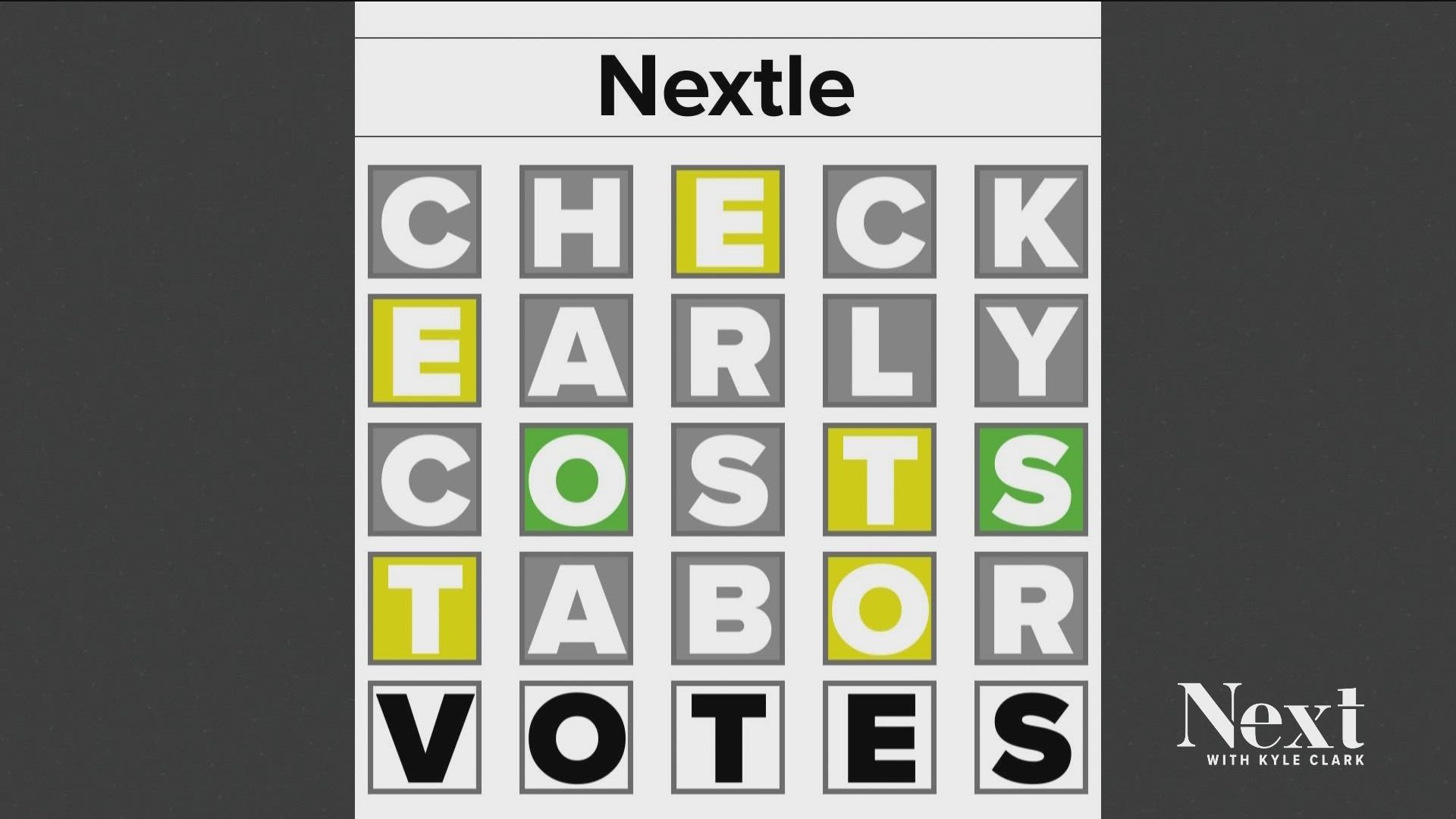

Q: Convince us this is not just to get votes in November.

"This is really simple. This is money that is owed back to the people of Colorado. Why, as a state, should we just continue to do what we've done in the past, and hold on to it 'til the end of the next fiscal year, eight or nine months later, when we know how much is there? In some years we don't know -- maybe there's a TABOR refund, maybe there is not. This year, it's very clear we're going to have a very significant TABOR refund. Why should we sit on that money and not have it in your hands?" said Ferrandino.

Inevitably, residents will not get a check that they thought they should receive.

Ferrandino said that the bill that legislature is working through will provide funding for the state to set up a call center.

Q: Will residents talk to a human when calling a "where is my refund" call center?

"Our goal is to make sure we have the staff to be able to answer. There might be some wait time as the checks start to go, but our commitment is to continue to ensure that we can answer people's questions and support them in getting their checks," said Ferrandino.

Q: What if you didn't live here all year?

A person needs to have lived here for the entire 2021 calendar year and had to have filed a return or apply for the PTC grant by the statutory deadlines to claim the refund. If you moved since 2021, the state will send the check to the last known address as written on their tax return. You can update your address on Colorado’s address change form.

SUGGESTED VIDEOS: Full Episodes of Next with Kyle Clark