If you needed a good reason to read the 9NEWS voter guide, or your Blue Book, take a look at one example of one Amendment on your November ballot.

AMENDMENT 73 - Funding for Public Schools

SHALL STATE TAXES BE INCREASED $1,600,000,000 ANNUALLY BY AN AMENDMENT TO THE COLORADO CONSTITUTION AND A CHANGE TO THE COLORADO REVISED STATUTES CONCERNING FUNDING RELATING TO PRESCHOOL THROUGH HIGH SCHOOL PUBLIC EDUCATION, AND, IN CONNECTION THEREWITH, CREATING AN EXCEPTION TO THE SINGLE RATE STATE INCOME TAX FOR REVENUE THAT IS DEDICATED TO THE FUNDING OF PUBLIC SCHOOLS; INCREASING INCOME TAX RATES INCREMENTALLY OR INDIVIDUALS, TRUSTS, AND ESTATES USING FOUR TAX BRACKETS STARTING AT .37% FOR INCOME ABOVE $150,000 AND INCREASING TO 3.62% FOR INCOME ABOVE $500,000; INCREASING THE CORPORATE INCOME TAX RATE BY 1.37%; FOR PURPOSES OF SCHOOL DISTRICT PROPERTY TAXES, REDUCING THE CURRENT RESIDENTIAL ASSESSMENT RATE OF 7.2% TO 7.0% AND THE CURRENT NONRESIDENTIAL ASSESSMENT RATE OF 29%TO 24%; REQUIRING THE REVENUE FROM THE INCOME TAX INCREASES TO BE DEPOSITED IN A DEDICATED PUBLIC EDUCATION FUND AND ALLOWING THE REVENUE COLLECTED TO BE RETAINED AND SPENT AS VOTER-APPROVED REVENUE CHANGES; REQUIRING THE LEGISLATURE TO ANNUALLY APPROPRIATE MONEY FROM THE FUND TO SCHOOL DISTRICTS TO SUPPORT EARLY CHILDHOOD THROUGH HIGH SCHOOL PUBLIC EDUCATIONAL PROGRAMS ON AN EQUITABLE BASIS THROUGHOUT THE STATE WITHOUT DECREASING GENERAL FUND APPROPRIATIONS; DIRECTING THE LEGISLATURE TO ENACT, REGULARLY REVIEW, AND REVISE WHEN NECESSARY, A NEW PUBLIC SCHOOL FINANCE LAW THAT MEETS SPECIFIED CRITERIA; UNTIL THE LEGISLATURE HAS ENACTED A NEW PUBLIC SCHOOL FINANCE LAW, REQUIRING THE MONEY IN THE FUND TO BE ANNUALLY APPROPRIATED FOR SPECIFIED EDUCATION PROGRAMS AND PURPOSES; REQUIRING THE MONEY IN THE FUND TO BE USED TO SUPPORT ONLY PUBLIC SCHOOLS; REQUIRING GENERAL FUND APPROPRIATIONS FOR PUBLIC EDUCATION TO INCREASE BY INFLATION, UP TO 5%, ANNUALLY; AND REQUIRING THE DEPARTMENT OF EDUCATION TO COMMISSION A STUDY OF THE USE OF THE MONEY IN THE FUND WITHIN FIVE YEARS?

It sure looks like English and reads like English, but it's hard to follow.

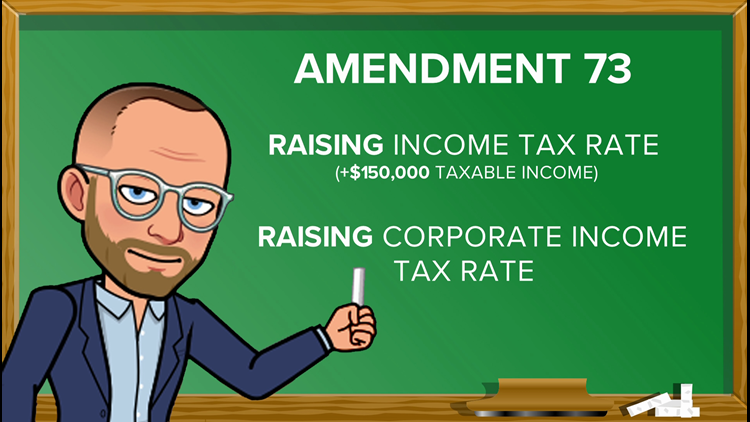

First, Amendment 73 is a ballot issue that would fund preschool through 12th grade by making a number of changes:

- Raise the income tax rate on those making more than $150,000 taxable income

- Raise the corporate income tax rate

- Lower the residential assessment rate for property tax, but capping the low end higher than projections show it would be reduced otherwise

- Lower the nonresidential assessment rate for property tax

The ballot title of Amendment 73 also has what might be bad English and/or math.

"It says that taxes shall be increased .37 percent and up to 3.62 percent, and that's not really accurate," said Luke Ragland with the No on Amendment 73 campaign.

Amendment 73 actually says, "Increasing income tax rates… at .37 percent for income above $150,000 and increasing to 3.62 percent for income above $500,000."

It actually means increasing .37 percentage points and 3.62 percentage points.

The same with the corporate income tax rate.

The ballot language says, "increasing the corporate income tax rate by 1.37 percent."

The corporate income tax rate is currently 4.63 percent. Amendment 73 would increase that to 6 percent. Increasing it 'by 1.37 percent' looks like this equation:

- 4.63 percent X 1.37 percent = 4.7 percent

"The voters probably aren't going to have an accurate picture of what they're voting on if they just read the ballot title language," said Ragland.

"Really, if people want to get more information about this measure, the place to do that is the Blue Book," said Colorado Deputy Secretary of State Suzanne Staiert.

In the Blue Book, the issue is broken down in layman's terms. It's spelled out clearly in two paragraphs:

"...increases the corporate tax rate from 4.63 percent to 6.0 percent."

The "text of measure," which is the language that gets inserted into state law, is written with the percentage increments correctly.

The only thing that appears to be inaccurate is the paragraph that appears on the ballot.

"Making a change like that after three million ballots have been printed, that's something we're just not going to do," said Staiert. "It's not being fixed because the way the title process works, it's an adversarial process and this one started way back in February."

She describes the process as a back-and-forth with supports and opponents of possible ballot issues that have challenges end up in front of the state Supreme Court.

"What typically happens at Title Board is opponents and proponents come in and they can talk about how they want the language to read. In this case, the proponent came in, we set the ballot title based on the information that we had and the conversation with the proponent, and then no one ever challenged it," said Staiert. "This title just went through without anybody raising any flags or any objections, and we didn't hear about this issue until, quite frankly, a couple of weeks ago, after ballots had already been printed."

"I'd love to see ballots corrected and sent out with a more accurate description of the tax increase," said Ragland.

It's not just Amendment 73 that has that type of wording.

Proposition 110, which would raise the state sales tax from 2.9 percent to 3.52 percent for 20 years to fund road projects is worded this way:

"…INCREASE THE STATE SALES AND USE TAX RATE BY 0.62% BEGINNING JANUARY 1, 2019…"

- 2.9 percent X 0.62 percent = 3.08 percent

That's different than increasing by 0.62 percentage points.

Again, the "Text of Measure" that goes into state law is written and worded correctly.

"The text itself can be pretty dense and difficult to read, so if you have questions about that, the place to go is either to the Blue Book or to look at the various information that's being distributed by the pro and con sides," said Staiert.

"I think voters need to be able to rely on reading the actual paragraph of text that's on the ballot itself, to get a full picture and to get an accurate picture," said Ragland.