DENVER — Colorado employees without a retirement savings plan could soon find themselves signed up for one.

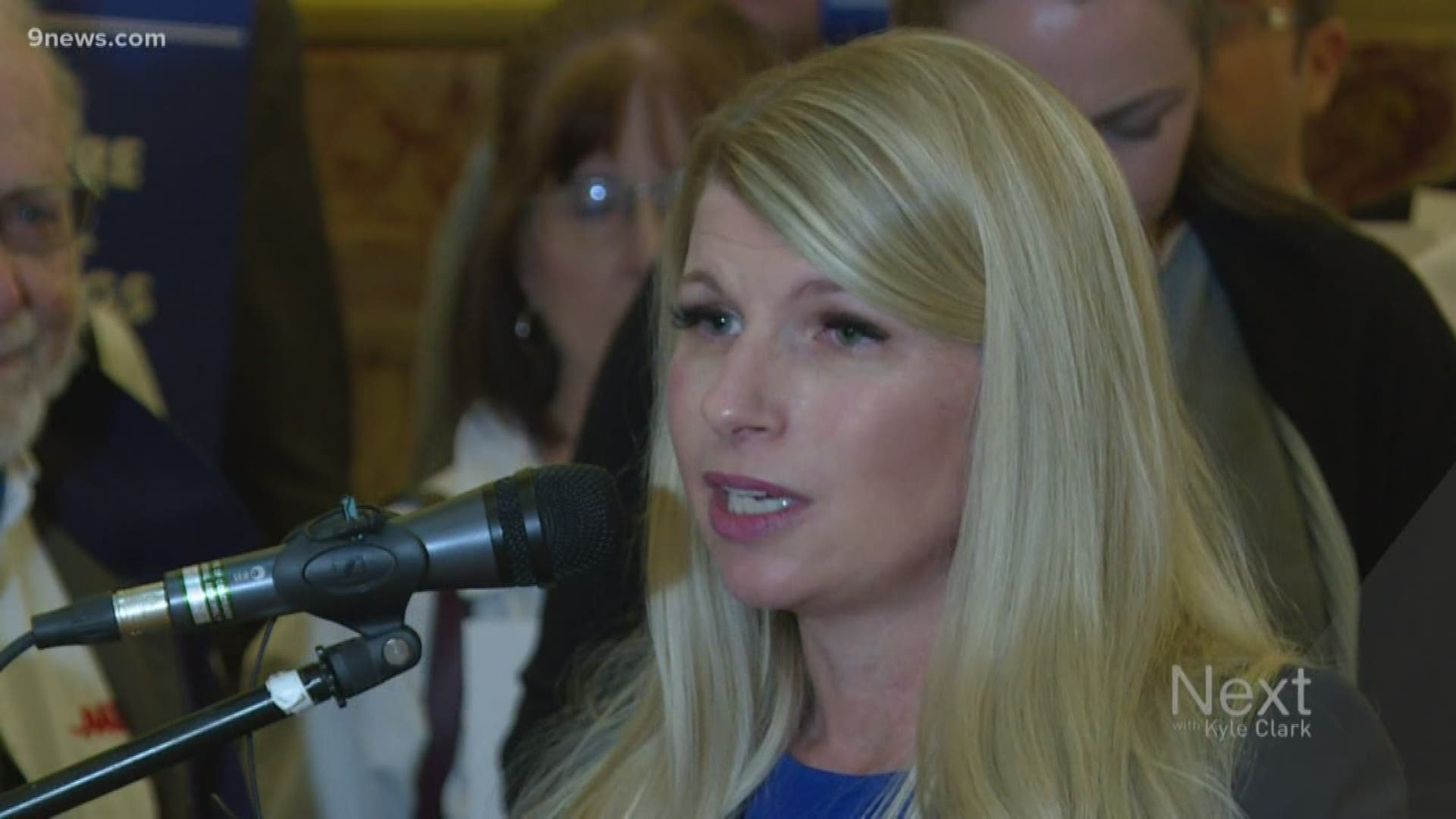

Senate Bill 20-200 proposes automatically enrolling employees in retirement programs if their workplace doesn’t offer them already. Democrats refer to the bill as a “Secure Savings Program,” designed to minimize the utilization of costly Colorado safety-net programs by retirees. State Sens. Kerry Donovan and Brittany Petterson, accompanied by State Reps. Tracey Kraft-Tharp and KC Becker are the primary sponsors of the bill, which was introduced in the Senate on Monday.

The bill would affect all businesses operating for longer than two years and with more than five employees. The savings program specifies that workers will be able to alter the percentage they contribute to their plan or opt-out entirely.

If SB 20-200 passes, it will affect almost one million workers in the state.

The bill was spurred by Colorado’s secure savings board, which found that “a state-facilitated automatic enrollment individual retirement account program” would be more cost-effective since it would supposedly avoid reliance on government-funded programs post-retirement. If passed, a study conducted by the board found that safety-net programs would save $10 billion over the program’s first 15 years.

According to a press release from Colorado State Senate Democrats, half of private-sector workers aged 25 to 64 aren’t offered retirement in their respective workplaces. The Wall Street Journal claims that, for the first time since Harry Truman’s presidency, the generation approaching retirement age is “in worse financial shape than the prior generation.”

Similar bills were proposed in Colorado’s legislature in 2016, 2017 and 2018, but did not pass. States such as Oregon and California have adopted similar bills into law.

Petterson, a millennial herself, claimed it’s becoming less and less likely for young workers to stay with one job for the duration of their career. The Secure Savings Program would allow workers to contribute to the same IRA account, regardless of whether they move between jobs or work multiple jobs.

“Many jobs don’t offer a plan and unless you are paying into a retirement account automatically through your employers, it can be near impossible to consistently put money away," Petterson said. "The economy is changing, gone are the days where most workers have a pension."

Opponents to the bill, the majority of which are Republicans, are calling the bill a “government retirement scheme,” arguing that the jurisdiction to open an IRA account should belong to individuals, not the government.

The Secure Savings Program bill will be heard in the State Senate Committee on Finance.

SUGGESTED VIDEOS | Politics