DENVER — Property tax bills will continue to rise, even with a last-minute compromise by lawmakers on the last day of the state legislative session.

The math to understand your future property tax bills, however, is much more complicated to figure out.

Senate Bill 24-233 is the last-minute property tax legislation that is set to pass the legislature and get sent to the governor.

The short version of the bill is that your future property tax bills will continue to go up, just not as much as if lawmakers did nothing.

In 2020, voters repealed the Gallagher Amendment, which limited the growth of residential property taxes, and put more of the property tax burden on commercial properties.

Since then, residential property taxes have increased dramatically.

So, how will your property tax bill still go up, but stop going up so fast?

Property tax bills are based on your home’s assessed value.

The assessed value is put through a math equation to determine your home’s taxable value.

That taxable value is used in an equation with each taxing district that your property taxes fund: cities, counties, school districts, fire districts, libraires, etc.

The bill would make several changes to the equation over the next three years.

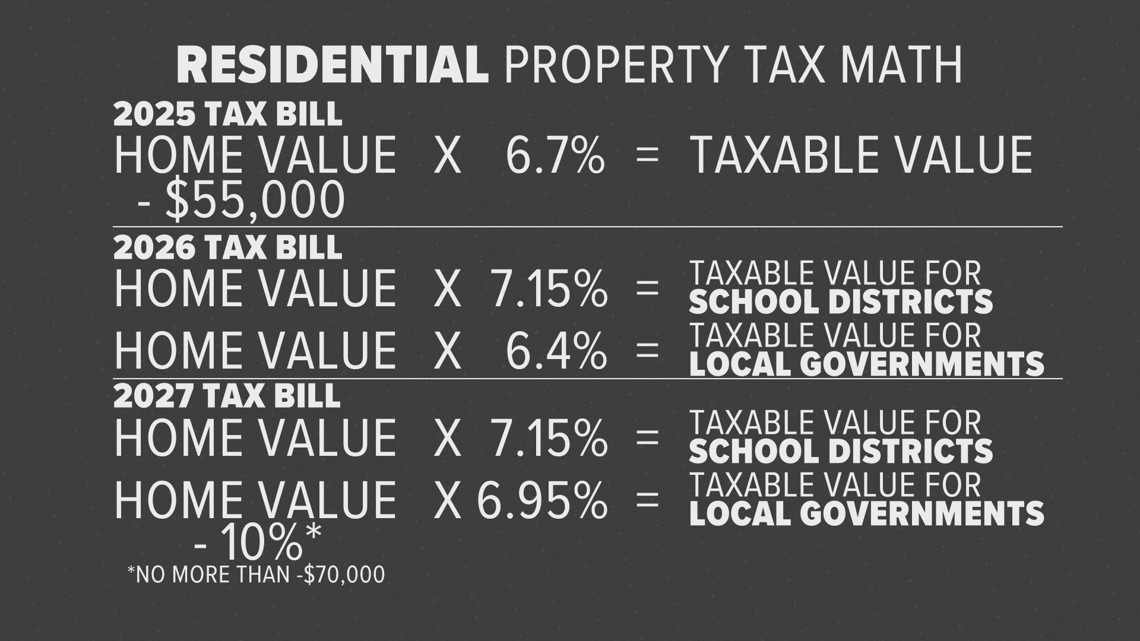

Check out the following chart to follow along:

Next year’s property tax bill will use the same equation as this year’s property tax bill.

In 2026, though, there will be two equations. One for school districts, with a higher assessment rate, and one for local governments, with a lower assessment rate.

Then in 2027, the two equations change slightly, with the local governments' equation providing a portion of your home’s value tax-free – 10%, but not more than $70,000. Although you get a discount on your home’s value, the assessment rate part of the equation increases.

There is one ballot issue already qualified for the November election that asks voters to limit property tax growth to no more than 4%. Should that get 55% approval and pass, the math equations put together by the state legislature in Senate Bill 24-233, will not take effect.

SUGGESTED VIDEOS: Next with Kyle Clark