DENVER — Proposition HH is the biggest, and most confusing, item on your ballot this November. We're here to help you break down what exactly a "yes" or "no" vote would mean.

If you vote YES on Proposition HH:

A YES vote on Proposition HH does not lower your property tax bill to a dollar amount less than what you paid this past year.

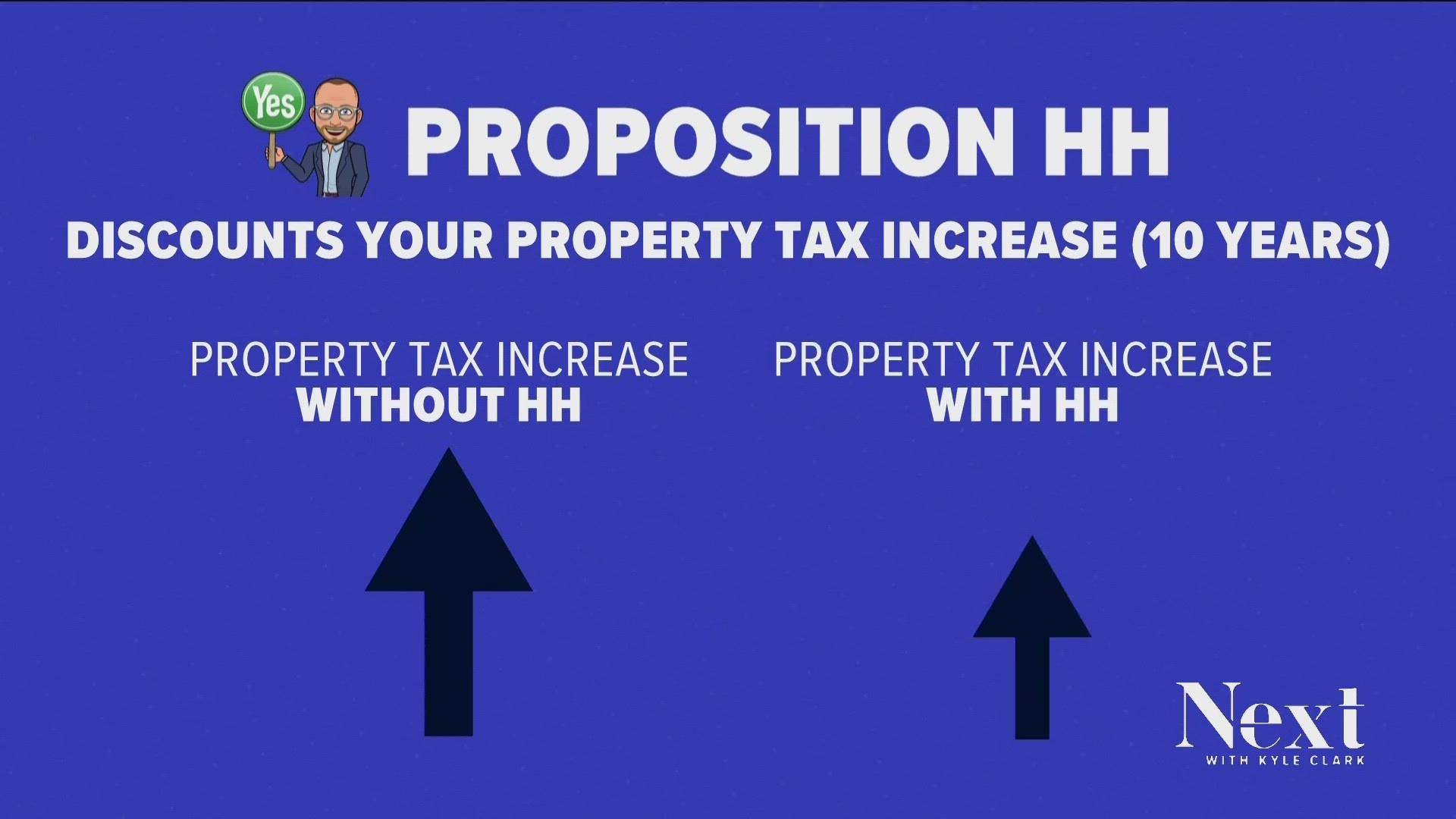

A YES vote creates a discount on your property tax increase for 10 years. Next year, your property tax bill will still go up, just not as much if HH passes. The higher the value of your property, the more money you will save.

A YES vote allows seniors to take the senior property tax exemption with them to new homes. Those who are 65 and older and have lived in their home for 10 or more years get a portion of their home's assessed value tax-free and Prop HH makes the discount portable to new homes.

A YES vote allows the state to keep and spend more each year than is currently allowed. That money would normally be refunded back to you as a TABOR refund.

With the exception of next year, a YES vote reduces your future TABOR refunds and could eliminate them in some years depending on future, unknown economic factors.

The extra money that a YES vote allows the state to keep and spend would go to three areas:

- Some would go to local governments, since they would be receiving fewer property tax dollars than if HH failed.

- Up to $20 million each year would go to a rental assistance fund.

- And the bulk of the money would go to school districts to pay them back entirely for the lost property tax revenue that would have existed if HH failed. Money beyond that would go to the state education fund.

A YES vote puts a limit on how much some local governments can collect in property tax revenue each year, unless those local governments hold a public meeting and vote to keep more than would be allowed.

Only if you vote YES will TABOR refunds next year be equal no matter your income level. That means if you make up to $99,000, you will get a larger TABOR refund. If you make more than $99,000, your TABOR refund will be smaller. In future years, everyone's TABOR refund would be reduced overall, with higher income earners seeing more dollars taken away.

If you vote NO on Proposition HH:

A NO vote makes no changes to the current property tax structure.

A NO vote does not allow the state to keep and spend more money than is currently allowed.

A NO vote would distribute next year's TABOR refund based on your income level, meaning fewer dollars for low-income earners and much more TABOR refund for high income earners.

More from 9NEWS on Proposition HH:

SUGGESTED VIDEOS: Next with Kyle Clark