DENVER — Property assessors for nine metro Denver area counties announced on Wednesday that property valuations, which help determine how much homeowners pay in property taxes, saw double-digit increases in their biannual assessment.

Douglas County saw the largest median residential increase at 47%, and the lowest was 33% in Denver. The metro area also includes Adams (38% increase), Arapahoe (42%), Boulder (35%), Broomfield (41%), Elbert (35%), Jefferson (36.5%) and Larimer (40%).

Assessors observed transactions and market conditions from Jan. 1, 2021, through June 30, 2022. Assessments will be mailed to property owners by May 1.

Property owners are encouraged to visit their county assessor's website to research sales their area during that timeframe. Anyone who thinks their property value is incorrect can file an appeal between May 1 and June 8.

Most assessors offer online appeal applications, and all accept written filings that can be mailed or dropped-off in person.

Watch the full news conference:

Property assessments, which are done every two years, are one piece of a three-part equation used to determine state property taxes.

The other two core components are the assessment rate determined by the state legislature, and the tax rate (or mill levy) set by various local authorities. Residents will not know the amount due for 2024 property taxes until the end of 2023, when the tax and assessment rates are set.

Below is a chart showing rate changes for the nine metro Denver counties:

- Adams County

- Median residential increase - 38%

- General Commercial Change - 42%

- Apartment / multi-family increase - 37%

“Adams County experienced significant increases in value reflecting the strong economic conditions across the Denver Metro area," said Adams County Deputy Assessor Tom Swingle. "The Assessor’s Office encourages property owners to review their accounts online to make sure the details of their property are listed correctly.”

- Arapahoe County

- Median residential increase - 42%

- General Commercial Change - 22%

- Apartment / multi-family increase - 20%

“The areas within Arapahoe County with the largest gains in residential property value were Aurora, Littleton, and Englewood," said Arapahoe County Assessor PK Kaiser. "Single family residential properties with the greatest level of demand and highest percentage increases were found in the lower price tiers while the market for higher value homes was slightly softer, resulting in moderate percentage increases.”

- Boulder County

- Median residential increase - 35%

- General Commercial Change - 41%

- Apartment / multi-family increase - 44%

“Boulder County continues to be a desirable place to live and work," said Boulder County Assessor Cynthia Braddock. "The latest property values recognize the desirability of the county and the strength of the real estate market during the appraisal period which ended June 30, 2022. We encourage property owners to double-check their property information and review comparable property sales via our website. If they find any errors or disagree with the values, they are encouraged to file an appeal by the June 8 deadline."

WATCH: Why Colorado property tax bills are going up (and the legislature might do about it)

- Broomfield County

- Median residential increase - 41%

- General Commercial Change - 20%

- Apartment / multi-family increase - 29%

“The City and County of Broomfield experienced significant increases due to a strong real estate market," said City and County of Broomfield Assessor Jay Yamashita. "We recommend property owners review their Notice of Valuations as soon as they are received and to contact the Assessor’s Office with any questions on that valuation. Sales used for analysis in the valuation process will be available on Broomfield.org on May 1, 2023.”

- Denver County

- Median residential increase - 33%

- General Commercial Change - 17%

- Apartment / multi-family increase - 45%

“We understand what a significant percentage change some of our homeowners and business owners may face in value," said City and County of Denver Assessor Keith Erffmeyer. "We do not know yet what property taxes will be and while we work hard to do a thorough assessment, we want property owners to take a close look at what they receive and tell us if they believe we haven’t gotten their value right.”

- Douglas County

- Median residential increase - 47%

- General Commercial Change - 19%

- Apartment / multi-family increase - 25%

“Due to our quality of life and strong economic foundations, we are accustomed to consistent population growth and intense demand for real estate," said Douglas County Assessor Toby Damisch. "In this reappraisal period, however, Douglas County experienced the largest increase in the residential property market since it has been tracked. This situation underscores the dire need for a policy change at the state level that protects Colorado homeowners and businesses.”

- Elbert County

- Median residential increase - 35%

- General Commercial Change - 30%

- Apartment / multi-family increase - n/a

“Elbert County’s western portion of the county continues to be a growing, bedroom community to the metropolitan districts along the Front Range," said Elbert County Assessor Susan Murphy. "The County’s overall rural lifestyle and quality of life, combined with a shift towards remote work and the transportation options provided by HWY 86, I-70, and HWY 24 continue to make Elbert County a desirable place for real estate buyers.”

- Jefferson County

- Median residential increase - 36.5%

- General Commercial Change - 20%

- Apartment / multi-family increase - 20%

“Thirty-six percent is a big number. If you have not been following the local real estate market, it might be a shocking number," said Jefferson County Assessor Scot Kersgaard. "For most people, property taxes probably will not go up by anything close to 36%. While I am disappointed that the legislature has not yet acted to moderate the effect values will have on taxes, there is every indication it will do so before tax bills are mailed early next year.”

- Larimer County

- Median residential increase - 40%

- General Commercial Change - 41%

- Apartment / multi-family increase - 23%

“The county’s scenic parks, trails, open spaces, and proximity to Rocky Mountain National Park have contributed to Larimer County becoming somewhat of a ‘Zoom town,’ for people who use technology to work remotely while being close to these amenities," said Larimer County Assessor Bob Overbeck. "We have fairly robust connectivity in urban areas with connectivity in outlying areas also improving.”

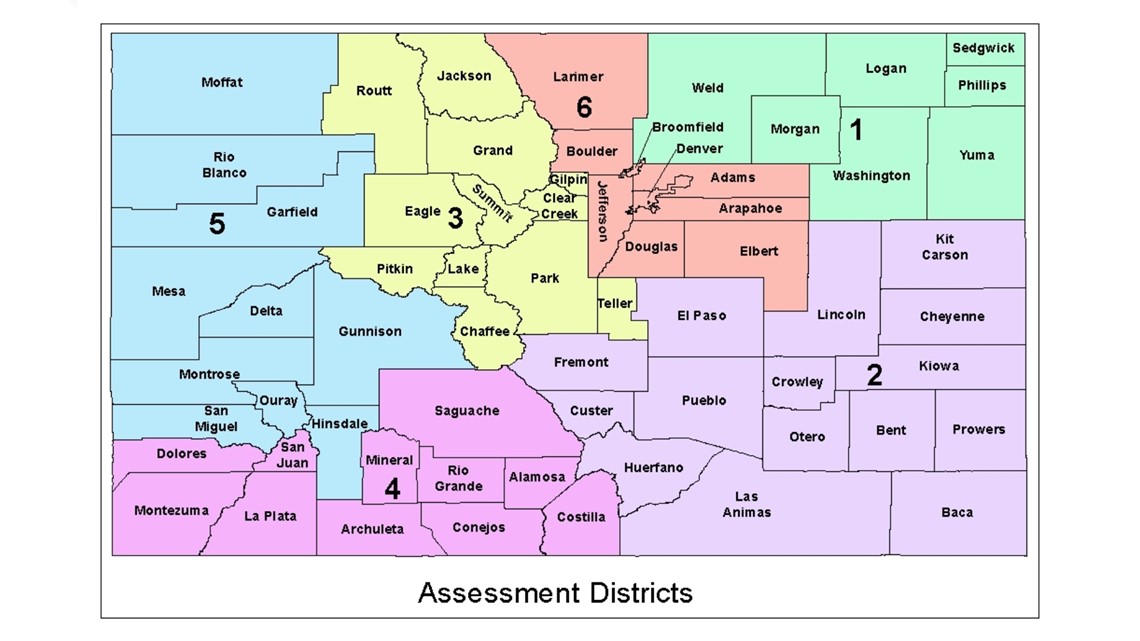

Assessors released a map showing the counties that make up the six assessment regions in the state:

They also released the median residential increase rate for each region:

- Region 1: Residential median increases of 25% - 35%

- Region 2: Residential median increases of 20% - 50%

- Region 3: Residential median increases of 40% - 60%

- Region 4: Residential median increases of 30% - 50%

- Region 5: Residential median increases of 30% - 60%

- Region 6 (Denver Metro): Residential median increases of 35% - 45%

SUGGESTED VIDEOS: Colorado real estate market