DENVER — Federal investigators have recovered more than $2 million in fraudulently obtained COVID-19 relief loans in the wake of a 9Wants to Know investigation that publicly exposed the scheme.

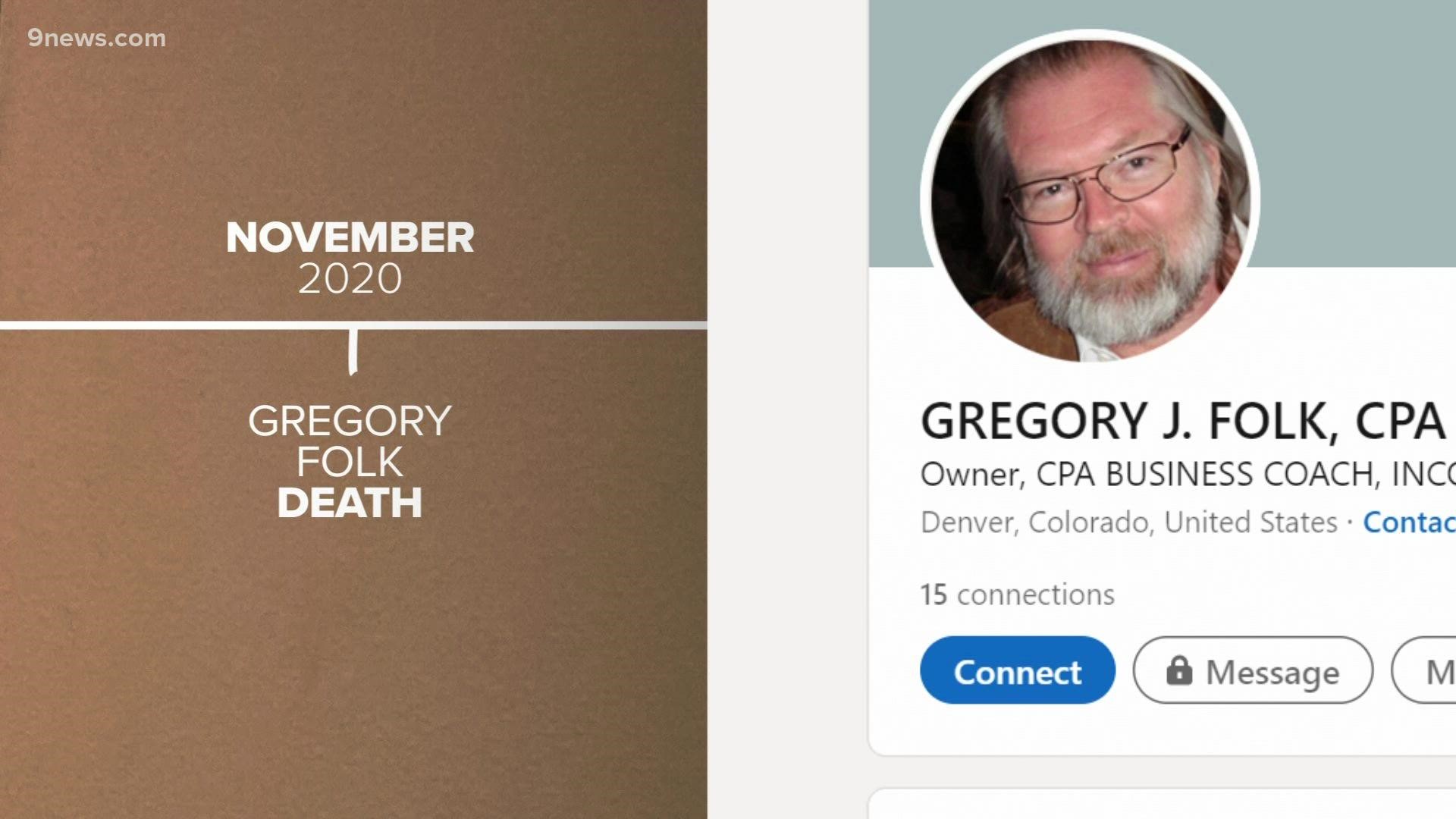

In August, 9Wants to Know revealed a longtime accountant named Gregory J. Folk was tied to more than 30 bogus and defunct businesses that were approved for $2.8 million in Paycheck Protection Program (PPP) funds.

About $2.5 million was disbursed before federal investigators caught wind of the scam and stopped the transfer of any more money.

According to court documents obtained by 9Wants to Know, the FBI identified a series of bank accounts where the loans were deposited, froze them and moved to seize the money still in them – about $2.275 million.

Roughly $225,000 remains unaccounted for. Folk allegedly moved some money before the bank froze his assets.

“A review of the accounts shows some of the funds were transferred to other accounts at Bank of America controlled by Folk after being initially deposited into the accounts above,” John Maglosky, a special agent for the FBI, wrote in documents obtained by 9Wants to Know.

A representative for Bank of America did not immediately answer questions on where the money went.

The 9Wants to Know investigation found that all of the entities that received the loans were traced to a single Denver office where Folk worked as an accountant before he was evicted in 2017.

Folk died in November 2020, a few months after the bogus companies he controlled received the COVID-19 relief money.

In November, the U.S. Attorney’s Office for the District of Colorado filed a civil case relating to $2.5 million in stolen PPP funds that were fraudulently dispersed to more than 20 Bank of America accounts controlled by Folk.

The court documents reveal that the FBI suspected Folk of PPP thievery in the summer of 2020 and that he “submitted PPP loan applications on behalf of forty (40) separate entities.”

Federal court records filed in March also indicate that the FBI visited Folk at his home in August 2020, but he refused to speak.

Elizabeth Baker-Folk initially claimed ignorance to the fraud and suspected someone stole her late husband’s identity in the scheme.

“Well, he had lots of enemies, so I’m not at all surprised,” Baker-Folk told 9NEWS in the summer of 2021. “He had some clients that were really unhappy, and he had some clients he stopped working with because they were kind of shystery.”

The court records filed in November also say an internet connection registered in Baker-Folk’s name was used to conduct most of the fraudulent transactions.

Baker-Folk was never named as a suspect.

She declined to talk to 9NEWS, claiming her attorney told her not to speak.

Robert Pence, a retired FBI agent who spent 30 years with the agency, said he was not surprised fraud has surrounded COVID-19 relief funds, and he pointed out amounts that have been reported stolen across the country are unprecedented.

“This is a crime, not only against the finances of the American government, but this is a crime against the health of the people,” Pence said.

Below: Two federal affidavits for Gregory J. Folk:

If you have any tips about this story or fraud, you can email jeremy.jojola@9news.com.

SUGGESTED VIDEOS: Investigations from 9Wants to Know