JEFFERSON COUNTY, Colo. — Your state TABOR refund will show up on next year's tax return.

It is not a special check just before an election like Colorado Democrats chose to do last year.

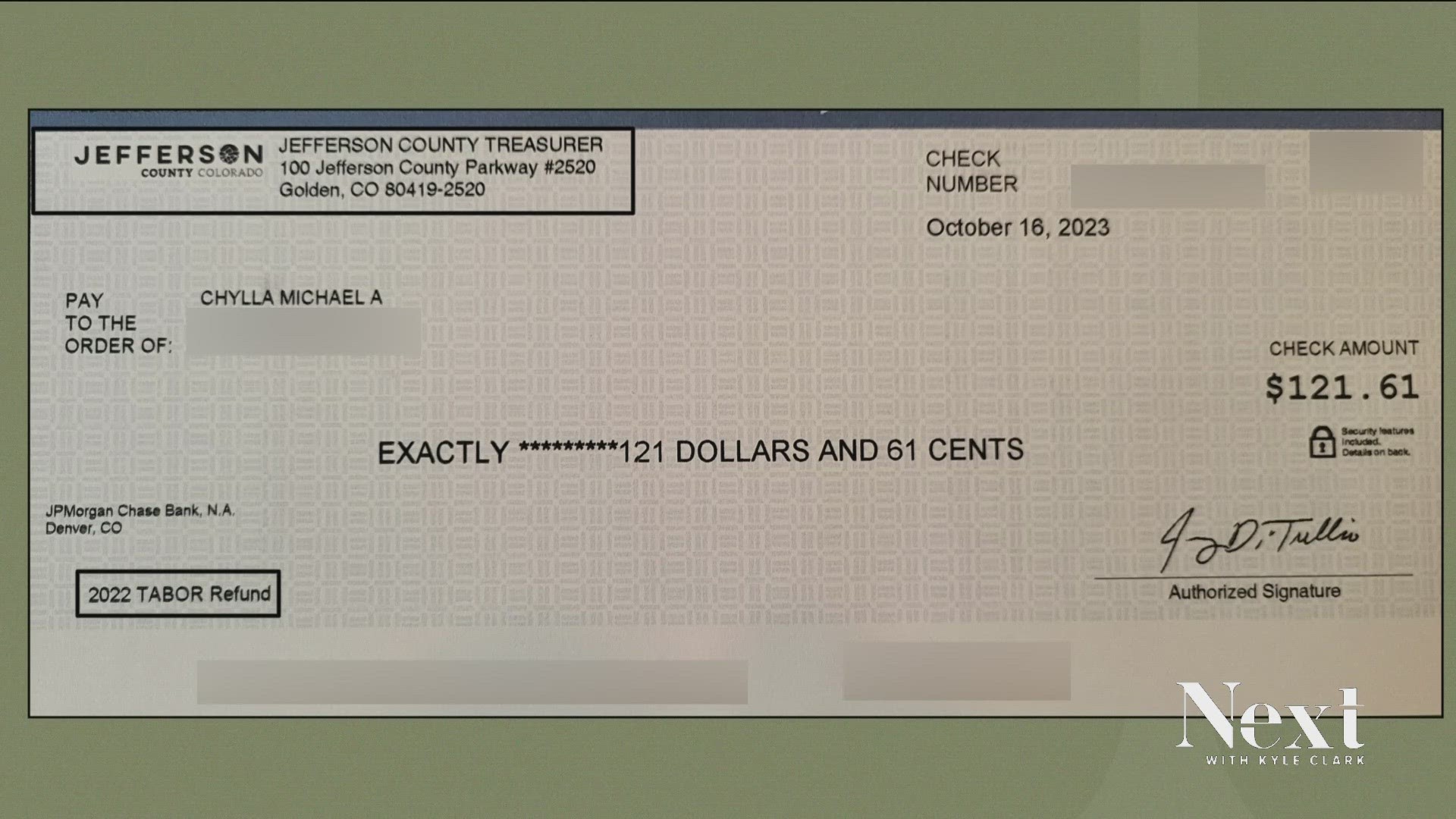

The change in how you will get your TABOR refund this year is a bit confusing for Jefferson County residents, who are receiving county TABOR refund checks in their mailbox this month.

Mary from Arvada and Mike from Jefferson County wanted to know why their TABOR refund check was so small compared to last year.

The answer is because they are not the same kind of TABOR refund check.

These are Jefferson County-specific refunds.

The county just sent out 210,000 refund checks.

“Our refund for 2022 was $39.4 million, and that was property tax revenue collected that was over the amount that we were allowed to retain,” Stephanie Corbo, Jefferson County’s chief financial officer, said.

Of Colorado’s 64 counties, 51 of them have broadly removed TABOR limitations. Jefferson County is one of 13 that have not done so, meaning residents can get localized TABOR refunds.

“We're one of the outliers at Jefferson County,” Corbo said.

The average Jefferson County TABOR refund is $187. Most residents received between $90 and $120.

“We do it in the form of a proportional share of what you paid in, to every taxpayer, and we send it out in the form of a check,” Corbo said.

The checks cost 97 cents each, but Corbo said sending a check is cheaper than trying to credit property tax bills.

“Our system that collects property taxes, it's really antiquated. When you look at the configuration it would take to actually put a credit on your property tax bill, it was more than double the amount of cost than mailing a check.”

The math for Jefferson County is different from the math for the state, when it comes to the amount of money that can be kept and spent.

The state is limited to inflation plus population growth. Though, Prop HH seeks to change that formula by adding one percentage point each year.

Population is not part of Jefferson County’s TABOR limit.

“TABOR only grows based on inflation and net new construction, whereas the state grows by inflation and population growth,” Corbo said. “If we can only grow by inflation, and we have new population move in, we don't have the revenue to be able to support that new population coming in, and so then, you just have more scarce and scarce services.”

Jefferson County is limited to a revenue increase of no more than 5.5% each year, and less if TABOR growth is a lower percentage.

“Last year, in 2022, when we had 8% inflation, we're not allowed to grow more than 5.5% on our property tax revenue., so we couldn't benefit from that inflationary growth,” Corbo said. “If this Proposition HH passes, essentially what would happen is it would just restrict our revenue more than what TABOR does.”

That could result in higher Jefferson County-specific TABOR refunds for county residents, but perhaps, at the expense of county services.

“We have about a $500 million backlog on our infrastructure,” Corbo said. “When you think about new populations moving in, new communities being built, and you want bike lanes and you want your roads maintained, we're really struggling with the amount of revenue we have, since it is so limited, to just keep pace with ongoing maintenance, as well as really providing any type of new infrastructure.”

In 2019, Jefferson County tried to get voters to exempt the county from the TABOR limits for seven years, but that ballot issue failed.

SUGGESTED VIDEOS: Full Episodes of Next with Kyle Clark