DENVER — Next month, the state will begin mailing out a portion of your tax refund -- a refund you're getting because of the Taxpayer Bill of Rights (TABOR).

Single tax filers will get $750 checks. Joint tax filers will get $1,500 checks. This money will come via physical check in the mail.

These checks are conveniently arriving before November's election. Colorado Democrats pushed for these direct checks, with the help of a few Republicans, to get voters money now. By doing so, it changed how much each person will receive.

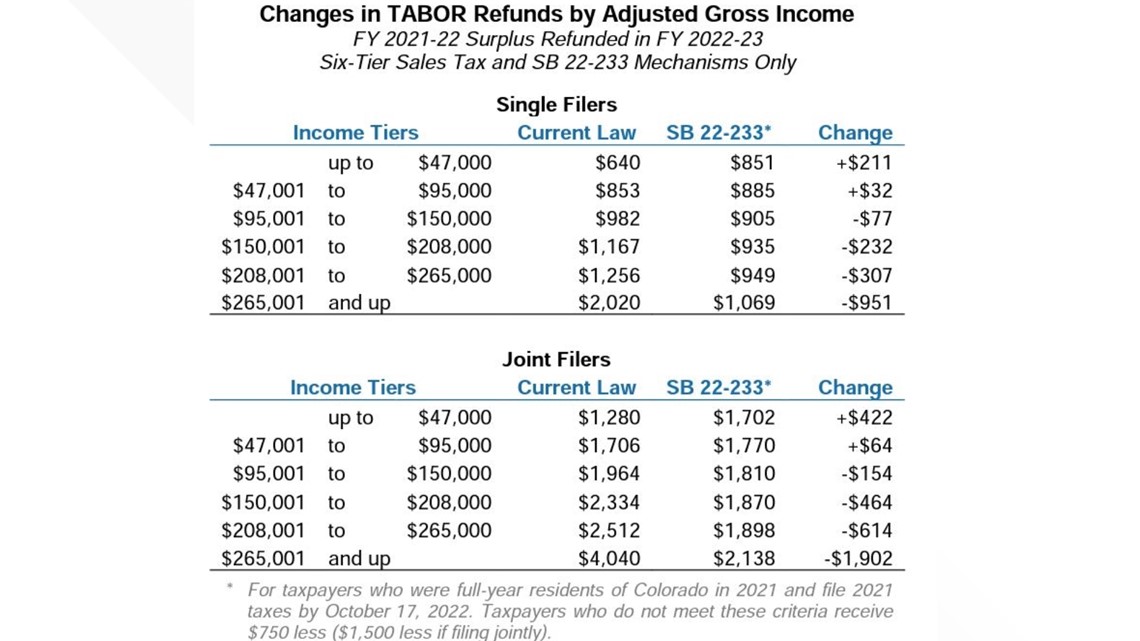

Since $750 is going to every person who filed state taxes by June 30 and lived in Colorado all of 2021, it changes the pot of money that would normally be divvyed up among six income levels.

Lower income earners will receive more money because of the direct check, while high income earners will receive fewer dollars.

"I think what we have this year is going to work really well. It was also predicated on the need for moving quickly because of the economic pressure that people are under, we wanted to get the refunds checks to people as fast as we could," said State Sen. Chris Hansen (D-Denver). "And so having a flat payment was really a useful way to speed up that process."

Hansen helped get the direct check passed at the state legislature.

It is a function of TABOR, which Hansen would rather do without.

"I think the state would be much better off without the constitutional restrictions found in TABOR," said Hansen.

TABOR limits how much the state can keep and spend each year. When the state goes over that limit, TABOR refunds happen.

The first mechanism for TABOR refunds is through a senior and veteran property tax exemption. The second is through a temporary income tax rate reduction. Normally, the third mechanism is through a sales tax refund that goes through six-income tiers and is sent back as tax credits when state income taxes are filed.

This year, the state will issue direct refunds, which means that six-tier tax credit fund is reduced from $3.2 billion to $514 million.

"Having the refund mechanism be more equitable, less regressive, is a good outcome for this year," said Hansen.

Low income earners will receive $211 more between the direct check and next year's tax credit than they would have without the direct check.

High earners will receive $951 less between the direct check and next year's tax credit because of the equitable direct check payment.

State Sen. Bob Rankin (R-Carbondale) said that he is against the equitable distribution, and would rather the state reduce the income tax. A lower income tax would mean Coloradans keep more money during the year and lessen the change of the state hitting a TABOR refund level. However, if there is a lower income tax rate and the state does not hit a TABOR refund level, that means the state may have fewer dollars for state programs that it funds.

Hansen would still rather do without TABOR to have more money for some of those programs.

"We've got the need to better fund our schools, to better fund higher education, to do more on infrastructure in the state, and the current restrictions that we have because of TABOR are significantly hampering our ability to deliver those things that the voters want," said Hansen. "I think there are clear needs that being unmet. We're still significantly behind on K-12. And so, I think for most working families, they would rather have that investment in schools than a small addition to a refund check."

People who filed taxes with an extension can expect checks to be mailed by Jan. 31, 2023.

SUGGESTED VIDEOS: Full Episodes of Next with Kyle Clark