DENVER — This story is part of a series of statewide ballot issue reviews for Next with Kyle Clark we're calling "We Don't Have To Agree, But Let's Just Vote." We'll continue to look at statewide ballot initiatives on Colorado's ballot and how they would impact you.

PROPOSITION EE

A YES vote increases cigarette and tobacco taxes, and creates a new tax on nicotine and vaping products.

A NO vote keeps today's taxes in place, which includes no tax on nicotine and vaping products.

The ballot issue is written in all capital letters because Colorado's Taxpayer Bill of Rights (TABOR) requires tax questions to be written a certain way.

In June, state lawmakers passed House Bill 1427, which became Proposition EE. The bill was introduced on June 11 and passed by both the House and Senate by June 15. A rare number of bills each year are passed that quickly. Bills need a minimum of three days to be passed by the legislature.

Democratic Gov. Jared Polis signed the bill, but since it seeks to increase taxes, TABOR requires a vote of the people.

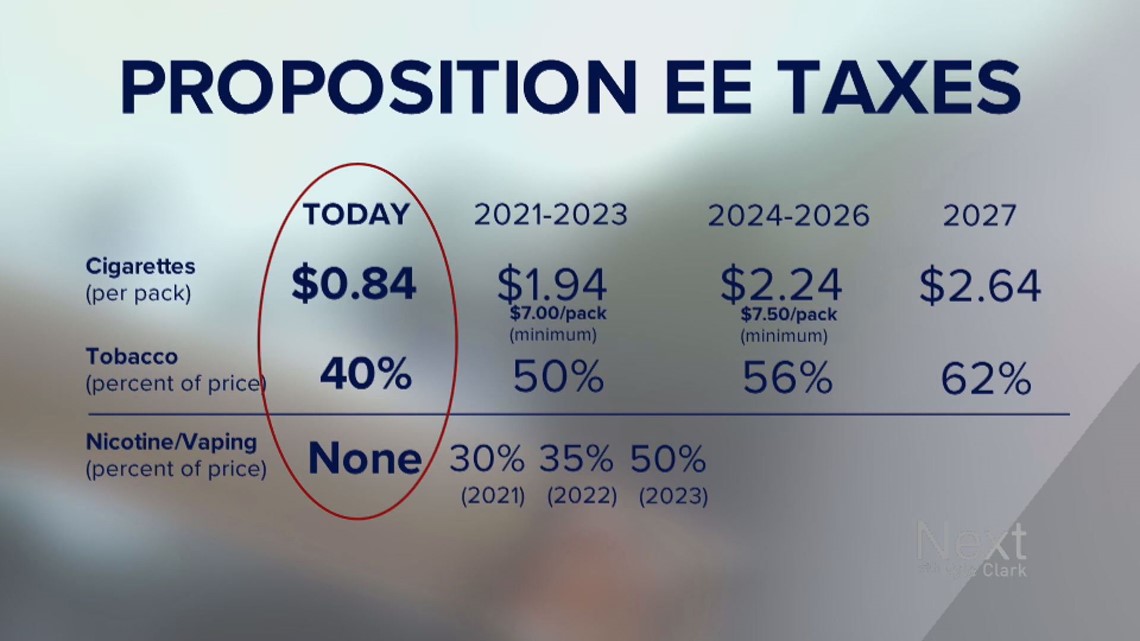

Currently, cigarettes are taxes at $0.84 per pack.

Here is what the tax structure would look like for cigarette packs, tobacco and nicotine/vaping products if you vote YES on Proposition EE:

Starting in 2021, cigarette packs would also have a minimum after-tax price of $7.00. After July 2024, the minimum after-tax price would be $7.50.

If voters pass Proposition EE, lawmakers determined how it would be spent through House Bill 1427. However, future legislatures could always change how the money is spent.

From January 1, 2021, to June 30, 2021, Proposition EE is estimated to generate $87 million in new tax revenue, and $177 million in the first full fiscal year (July 2021-June 2022).

For the first three years, through June 2023, the money would go to:

- Rural schools

- K-12 education

- Affordable housing and eviction assistance

- Tobacco education

- General state spending

Of the money that gets set aside for rural schools, 55% would be allocated for rural school districts between 1,000 and 6,500 students, and 45% for districts with fewer than 1,000 students.

After July 2023, the money would be spent on:

- Preschool programs

- Health care

- Tobacco education

- General state spending

The money for preschool would be used to expand preschool, to provide at least 10 hours per week of free preschool for every child in their final year before kindergarten.

The health care spending would be for Medicaid, primary care, tobacco use prevention, children's health and other programs that already receive current cigarette and tobacco tax revenue.

The YES on EE campaign includes:

- A Brighter, Healthier Future for Kids in Lafayette

- Save the Children Action Network (SCAN) in Washington, D.C.

Campaign finance records kept by the Colorado Secretary of State's Office shows that A Brighter, Healthier Future for Kids has received more than $3.5 million in contributions as of Oct. 12.:

- $1 million - Gary Community Investment Company, which has a mission "To improve the lives of Colorado’s low-income children and families by investing in quality early childhood and youth development systems and expanding sustainable economic opportunities."

- $460,000 - Education Reform Now Advocacy out of New York, NY.

- $400,000 - Healthier Colorado

- $250,000 - philanthropist Pat Stryker

- $100,000 each - Jacklyn and Miguel Bezos, parents of Amazon founder Jeff Bezos

- $50,000 - Colorado Rockies owner Dick Monfort

- $50,000 - Boldly Forward Colorado, the committee originally formed by Polis to transition from the Nov. 2018 election to his inauguration.

The No on EE campaign has produced billboards that mention a tax hike, but none of the billboards reference cigarettes, tobacco or nicotine.

The group behind the No campaign is "A Bad Deal for Colorado."

The campaign finance records from the Colorado Secretary of State's Office shows contributions totaling more than $3 million as of Oct. 12:

- $3 million - Liggett Vector Brands, discount cigarette maker in Morrisville, NC

- $100,000 - XCaliber International LTD LLC - cigarette and tobacco company in Pryor, OK

- $8,500 - Smoker Friendly in Boulder

RELATED: Don't want to miss important dates leading up to the election? Try one of these phone backgrounds

SUGGESTED VIDEOS: Breaking down Colorado's 2020 ballot